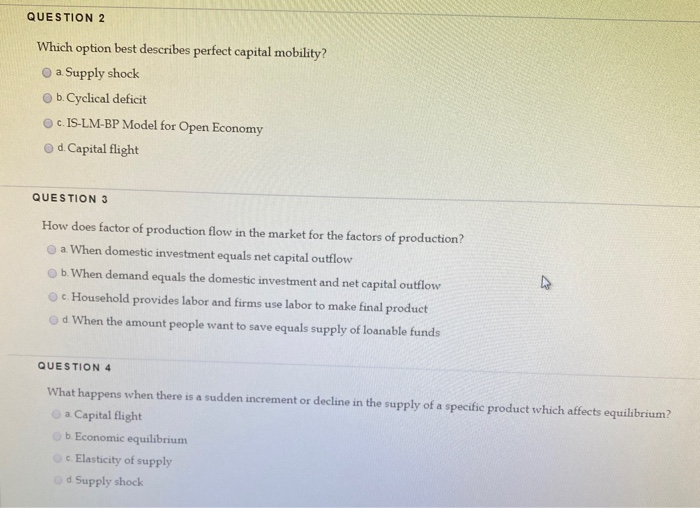

Which Option Best Describes Perfect Capital Mobility

In global financial markets mobility of capital provides access to a global pool of savings at. When there is a sudden increment or decline in the supply of a specific product which affects equilibrium what occurs.

Week 6 Quiz Docx Question 1 0 Out Of 20 Points Which Option Best Describes Perfect Capital Mobility Selected Answer B Cyclical Deficit Question Course Hero

Policy is a decrease in the interest rate.

. As indicated in Barro and Sala-ì-Martin 1995 a straightforward extension of the Ramsey model to the open economy case under the assumption of perfect capital mobility eliminates all interesting dynamics. A program that increase the exportation of a product decrease in the price of that product while reducing its sales. Decreases and the real exchange rate.

The sum of net capital outflow and domestic investment. A program that allows reduction of an imported product and increase in the price of that product while reducing its sales. That Canadians can invest abroad but foreigners cannot invest in Canada.

That capital is free to move from one sector to another c. Your answer is correct. The book describes the difficulties of the current international corporate income tax system.

It is the perfect mobility of capital that makes domestic interest rate r equal to the world interest rate. Equal to the world real interest rate. Assume Canada is a small open economy with perfect capital mobility.

Canada is characterized by perfect capital mobility What does this mean in the language of economics. There are no barriers to capital in and out of a country or between uses including exchange rate barriers. Either domestic or foreign depending on which investment offers relatively high rates of return.

The perfect capital mobility theory predicts that countries with high relative savings have higher investments. Has no effect on domestic AD because tax rates move in an offsetting way b. IS-LM-BP Model for Open Economy.

If due to some event or economic policy domestic interest rate happens to be lower than the world interest rate the capital outflows would drive the domestic interest rate back to the world interest rate. Cyclical deficit is defined when the amount by which a governments spending is more than it receives in taxes at a time when the economy is not performing well. If the interest rate is 8 percent in Canada and 6 percent in China and if the exchange rate is stable at 6 Chinese yuan for one Canadian dollar what would happen.

Is moderated by a change in the exchange rate С. Question 1 0 out of 20 points Which option best describes perfect capital mobility. Capital immobility when capital faces.

Total production is equal to net capital outflows. View week 6 quizdocx from ECON 195 at Bryant Stratton College. Sharing best practice and limiting certain types of tax competition.

In the open-economy macroeconomic model if a country becomes a better place for business and its interest rate has the tendency to increase its net capital outflow. Domestic interest rate equals the world interest rate. Perfect Capital Mobility means that an enormours quantity of funds will be transferred from one currency to another whenever the rate of return on assets in one country is higher than in another.

Assuming there is perfect capital mobility compared to a large open economy a small open economy is one in which the. Which option best describes Voluntary Export Restriction. That capital is free to move across provinces in Canada b.

Question 16 Which option best describes perfect capital mobility. In a country with a small open economy the real interest rate will always be. Which option below best describes perfect capital mobility.

Perfect capital mobility is a situation where capital is free to move in pursuit of higher returns. Changes domestic interest rates O d. With Perfect Capital Mobility the depre-ciation in the currency would cause the IS curve to shift to the right until i i.

Assets that measure goods and. Tax Coordination Under Perfect Capital Mobility Jeux sans frontières Capital Mobility and Tax Competition Tax Competition Tax Coordination and Tax. Unrestricted capital flows further offer several advantages.

How does factor of production flow in the market for the factors of production. Access to cheap funds. With Imperfect Capital Mobility the same shift in LM will cause a smaller capital inßow and thus a smaller depreciation in the currency.

Balances checking accounts and savings accounts c. Why is capital mobility important. Hence the IS curve will.

Paper bills and coins held by the public and government d. Unrestricted capital flows further offer several advantages. Economists tend to favor capital mobility across national borders as it allows capital to seek out the highest rate of return.

A small open economy with perfect capital mobility is not characterized by the fact that. In the open-economy macroeconomic model the demand for loanable funds comes from. Business Economics QA Library Under a fixed exchange rate system with perfect capital mobility the effect of an internal shock from a change in autonomous consumption.

People use it to transfer purchasing power from the present to the future b. Which option best describes the function of money. Capital Mobility and Immobility.

Definition of capital mobility easy for physical assets and finance to move across geographical boundaries. Even though both economists researched about the same topic at about the same time both have different analyses. This freedom of capital to move across borders is.

Its domestic interest rate always exceeds the world interest rate. Transitional dynamics are driven primarily by capital accumulation while exogenous technological progress accounts for long-term growth. IS-LM-BP Model for Open Economy dCapital flight Question 17 The formula for calculating the income elasticity of demand is______.

6 November 2017 by Tejvan Pettinger. V best describes perfect capital mobility. Percentage change in quantity demanded divided by percentage change in price b.

Mundells paper Capital Mobility and Stabilization Policy under Fixed and Flexible Exchange Rates 1963 analyses the case of perfect mobility of capital while Flemings model depicted in his article Domestic Financial Policies under Fixed and under. Which option best describes the function of money. In a small open economy a decrease in the exchange rate will _____ net exports and shift the _____ curve.

Week 6 Quiz Docx Question 1 0 Out Of 20 Points Which Option Best Describes Perfect Capital Mobility Selected Answer B Cyclical Deficit Question Course Hero

Solved Question 2 Which Option Best Describes Perfect Chegg Com

No comments for "Which Option Best Describes Perfect Capital Mobility"

Post a Comment